Investment outlook - 2024

Nuclear and renewable resourceThis past year 2023 was extraordinary for uranium, both from a price perspective – with uranium closing the year out at a 16-year high – as well in terms of increasing public and global government support for nuclear power. Uranium led all other commodities by an extremely wide margin with respect to full year performance, registering a stunning 1-year gain of +89.6%. The spot uranium price began 2023 at $48.00/lb. and ended the year at $91.00/lb. For comparison, the next best performing commodity was iron ore, coming in a distant second with a performance of +23.4% in 2023. Also consider the fact that on an overall basis, 2023 was a “soft” year for commodities, with the Bloomberg Commodities Index down over -11% over the last year.

The Uranium and Renewable Resources portfolio was launched at the end of October 2023, so we were not able to capture the full year increase of the uranium spot price and the commensurate uranium equity prices. Nevertheless, as can be seen in the historical performance graph below, the portfolio gained roughly 3.8% from October 25 to December 31, or 20% annualized. This performance was a result of our strategy of selecting equities and ETFs that satisfy the requirements of the 5 key points in our uranium strategy (link to the strategy page)

So, in view of the exceptional performance in 2023, what can we expect from uranium in 2024? Can we see a continuation of the uranium spot price uptrend, or can we expect a pull-back of some sort in 2024?

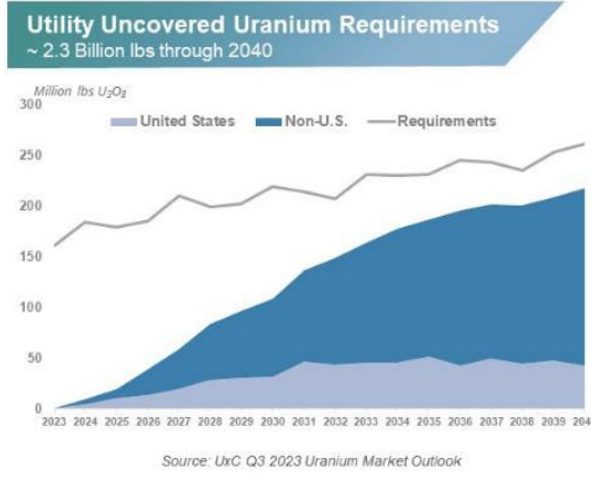

When we make projections for 2024, it is important to note that uranium is still in a structural supply/demand deficit, which is expected to continue for some time. This will fix some lower bounds for the uranium spot price, as well as for long term contractual prices for utilities that will be in the market for uranium purchases this year and the next. The supply/demand deficit is clearly shown in the below graphic.

The global primary producers, Cameco and Kazatomprom, are basically sold out for the next 4-5 years, and will not be able to meet expected demand. Second tier uranium miners are still more or less in the developmental stage and are not expected to contribute meaningfully to uranium supply for another 3-4 years. The catalysts for continuing Uranium price appreciation, in addition to the supply/deficit equation demonstrated above, are shown below:

1. Kazatomprom will fail to meet production goals for 2024 and 2025.

The world’s largest uranium producer, Kazatomprom (>40% of the world’s annual U3O8 production), issued a news release stating that they will fall short of their previously announced production goals for 2024, and likely 2025 as well, amounting to about a 20% production shortfall. Kazatomprom attributes the 2024 production miss to a lack of sulphuric acid availability and delays in construction development at certain new deposits (likely Budenovskoye 6&7 and South Tortkuduk). This obviously will impact Uranium spot prices, and will pressure western utilities to seek uranium delivery from other global sources, creating a very competitive market for uranium supply.

2. Acceleration of Global Government Policies in Support of Nuclear

There has been a recent surge of policy developments that portend significant government support of nuclear energy world-wide. Among these are the following:

- UK investment of over £300M to support domestic production of fuel required for next generation nuclear reactors. This investment was made by the UK government to decrease dependence on Russian sourced enriched uranium fuel. The UK has the goal of adding an additional 24 GW of nuclear power capacity by 2050

- The H.R.1042 Bill to ban Russian imported enriched uranium was passed by the US House on Dec. 11, 2023. This House bill contains waivers allowing the import of low-enriched uranium from Russia if the U.S. energy secretary determines there is no alternative source available for operation of a nuclear reactor or a U.S. nuclear energy company, or if the shipments are in the national interest. If the Bill is signed by the President in early 2024, it may cause the Russian government to retaliate and suspend any delivery of enrichment and conversion services to the US, thus significantly impacting uranium supply.

- France announced that it would build 8 new EPR2 reactors (1650 GW each), in addition to the 6 already previously announced. This significantly increases the portion of electricity provided by nuclear from its current 70%.

- The US Department of Energy (DOE) released its Uranium Enrichment RFP in December 2023. The RFP requests uranium enrichment and storage services as part of a measure aimed at stimulating a domestic supply chain for high-assay, low-enriched uranium (HALEU), the fuel required for some of the designs for next generation Small Modular Reactors (SMRs) . The action follows an RFP released in November 2023 for services to deconvert enriched uranium into metal, oxide, and other forms for advanced reactor fuel. The Grossmeister Uranium fund is well positioned in the companies that are expected to participate in the RFP and will be awarded contracts to manufacture enriched uranium fuel.

- Nuclear plant life extensions continue to be implemented in North America and Europe. As an example, EDF plans to extend the lifetime of 8 nuclear reactors in the UK. A lifetime extension generally means 20 to 40 years of additional plant operation, which will demand that much more nuclear fuel.

3. Growing Acceptance of Nuclear Power World-wide

In terms of acceptance, the most recent COP 28 conference resulted in a dramatic change in government attitudes towards the importance of nuclear power, with 22 nations signing a pledge to triple global nuclear capacity by 2050. Equally impactful is the fact that based upon polling, public attitudes have shifted measurably towards favoring the growth of nuclear power. This has held true even in Germany, which has been a stalwart opponent of nuclear power in the last few decades.

4. Favorable Uranium Sector Commentary and growing institutional interest

There have been more positive articles on nuclear appearing recently in the media. Among them was a December Wall Street Journal article entitled “Uranium Miners Can’t Keep Up with Demand”. In the article, UxC President Jonathan Hinze highlighted the current supply tightness: “Spot supplies appear to be extremely sparse these days.” In the same article, Treva Klingbiel from TradeTech (the other principal trade consultancy) was even more blunt: “Today, uranium market participants face an environment characterized by both rising spot and long-term prices, combined with a significant gap in the availability of material in the 2025–2028-time frame.”

U.S.-based Time magazine, a publication that has historically been generally negative about nuclear power, ran a strongly pro-nuclear article in December 2023 titled: “Nuclear Power is the Only Solution.”

In terms of institutional interest, Bank of America recently issued a uranium sector report that increased its forecast of uranium prices dramatically, from $78 to $105/lb. (+34%) for 2024, and from $75 to $114/lb. for 2025. We are nearly at these levels already in early 2024. With uranium prices passing the significant milestone of $100/lb., this is drawing ever more institutional investment interest.

5. Lack of new uranium mines to meet supply deficit.

Demand for uranium is expected to expand 28% by 2030 and nearly 200% by 2040. Tight supply and rising demand has already significantly impacted prices with 16-year highs of more than $100/lb at the start of 2024. The high spot price of uranium has incentivized the start of new uranium mine construction world-wide. However, owing to the extremely long lead time for uranium mine exploration to production of up to 10 years, new large uranium mines are not expected to come into meaningful production for at least 5 years, thus constraining the supply picture even more. This means there is a window of opportunity for investors in the Grossmeister uranium portfolio to profit from the current second tier miners that are poised to enter production within this time window.

According to Cameco, one of the world’s leading primary uranium producer, Long-Term contracting has just experienced its highest yearly volume since 2012, with UxC reporting 160.5M lbs. of U3O8 signed into long-term contracts in 55 separate deals over the course of 2023. In short, long-term contracting experienced its first year of replacement-rate contracting in over a decade. This long-term contracting volume is expected to increase over the next decade, with uranium pricing expected to increase to meet global demand.

Summary

As can be seen by the above points, the outlook for uranium in 2024 continues to be very positive. The supply picture will continue to be constrained by geo-political issues, such as the war in Ukraine, the problems with a military coup in Niger, and increased competition for uranium sources. China continues to be the most significant player, with its plan to grow its nuclear capacity by 150 GW in the next 15 years, which calls for the construction of 6-8 nuclear plants per year. The increasing competition for uranium supply will bid up uranium prices for the next 3-4 years, as new uranium mines that will alleviate the demand for nuclear. are still in the developmental stage. Look for increased uranium prices, which will drive uranium mining companies stock prices even higher in 2024. Of course, one cannot expect a continuous upward increase in uranium equities. This sector, by definition, is volatile, and we can expect both significant uranium equity market price increases/decreases to occur. However, looking at the yearlong view, the outlook for 2024 is definitely very positive.

The investments and services offered by Grossmeister Capital AG may not be suitable for all investors, given the past volatility of the uranium market. This is not a recommendation or advice to invest in this fund. If you have any doubts as to the merits of an investment, you should seek advice from an independent financial advisor

Key Figures

| Return | 8.55% |

| Volatility p.a. | 37.37% |

| Maximum Drawdown | -46.86% |

| Cash Amount | 0.29% |

| Number of Positions | 27 |

| Sharpe Ratio | 0.00 |

| Sortino Ratio | 0.00 |

Historical graph

| Figures for the last month | For 6 months | For the last year | For five years | Since launch |

|---|---|---|---|---|

| +25.74% | +25.95% | +15.93% | — | +4.09% |

Transactions Examples

| Instrument | PnL | Type of Transaction | Currency | Price | Date |

|---|---|---|---|---|---|

| Energy Fuels | Buy | USD | 5.94 | 16.06.25 | |

| enCore Energy | Buy | USD | 2.51 | 25.06.25 |

Documents

Contacts

Nuclear and renewable resource strategy follow the link to learn more