Investment outlook - 1st quarter 2024

Nuclear and Renewable ResourceAs discussed in the previous “Outlook 2024” report, uranium continues to be in a severe supply/demand deficit, which we expect to continue for the next 3-5 years. After reaching a high of $106/lb. on 01 Feb 2024, the U spot price hit a low of $83.50 on 13 March, recovering to end the first quarter at $88.50. The spot price has consolidated at this level, as utilities have more or less accepted this new price level. A new leg up may begin if the spot price crosses $90/lb., as geo-political tension rise, and various government initiatives to boost uranium production start to take hold The first quarter of 2024 proved to be a very volatile one for the uranium sector, but at the end of the day we ended up largely where 2023 ended off, albeit modestly higher.

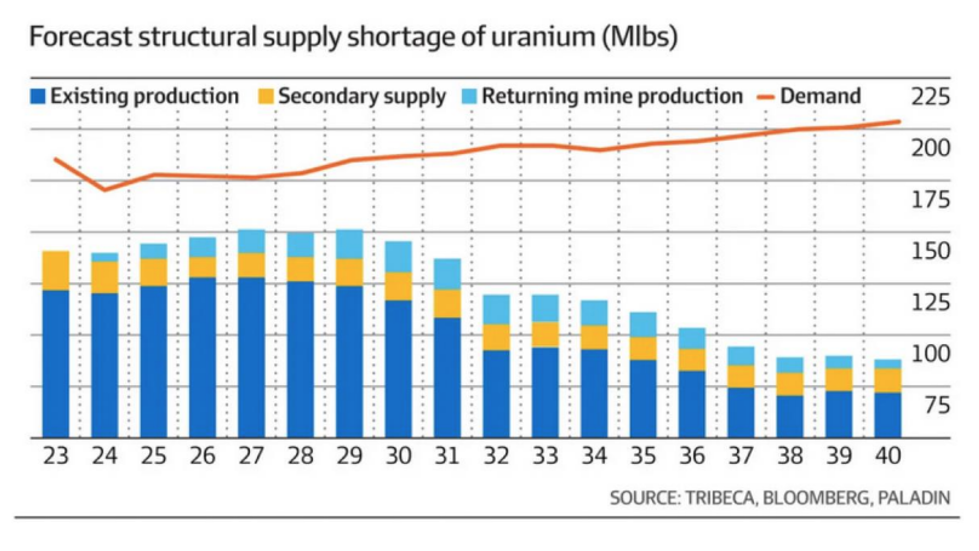

Bullish investors are betting on the long-term prospects of uranium due to a growing supply gap and increased demand as governments worldwide turn to nuclear power to counter climate change. Such demand comes as Canada’s Cameco Corp. and Kazakhstan’s Kazatomprom, which together account for half of global supply, warned of supply setbacks in the coming years. Kazatomprom, the No. 1 producer, said during its March 15 earnings call that it is projecting a 21 M lb. supply deficit in 2030 — a shortfall that would multiply to 147 million pounds by 2040.”

When we make projections for 2024 and beyond, it is important to note that uranium is still in a structural supply/demand deficit, which is expected to continue for at least 3-5 years or until new “greenfield” uranium mines come into production from vendors such as the NexGen and Denison mines. This supply deficit will fix some lower bound on uranium spot prices , as has been stated by some analysts in the mid-80’s level. Target prices for the high in uranium spot price have a wide range from analysts, as can be seen in the following:

- Bank of America (BofA) considers the Uranium market to be undersupplied in the wake of several years of inventory drawdown that is compounding into an extended structural supply deficit. They now expect this deficit will last until the end of 2029. BofA forecasts a uranium price of $105 for 2024, $120 for 2025. And $135/lb. for 2026.

- Goldman Sachs anticipates that the uranium spot price will average around $95/lbs. in 2024.

- Cantor Fitzgerald has increased its uranium price forecast from its previously set at $90 – $120/lb. Of U3O8. The firm is now calling for prices to be in the range of $120 – $150 per pound, with this range estimated to hold through 2028 and beyond.

Although much attention has been focused on the uranium spot price for U3O8, the more important price is the long-term price—the price at which utilities contract with uranium suppliers for several years in the future. These contracts specify the price for delivering uranium to utilities over an extended period (8,10, or 12 years). The long-term price has remained fairly stable in contrast to the volatility of the spot price. For example, when the uranium spot price declined from $106 to $83/lb. the long-term price remained stable at $75 and actually increased to $80/lb. in the first quarter of 2024.

Conclusion

We believe our long-term uranium demand thesis is still intact and well supported by the positive demand drivers below:

- Geo-political tensions in several global regions which impact uranium mining;

- The growing number of lifetime extensions in the US, Europe, and Korea, of existing nuclear reactors, as well as restarts as in the Japanese case;

- New reactor builds coming on line (primarily in China and India);

- The impact of the growth of Artificial Intelligence data centers, which consume extraordinary amounts of electricity, offering the potential for dedicated electrical power from co-located Small Modular Reactors (SMRs);

- The growing realization on the part of western utilities for the need to stockpile uranium for their depleting inventories;

- Emerging new generation nuclear technologies, such as SMRs, whose uranium demand has not yet been incorporated into current demand models, and;

On top of the above demand drivers, we see several government policies that have been enacted in the US and the EU to stimulate capital investment for uranium enrichment and funding for the construction of the existing generation of nuclear reactors, as well as for future Generation-4 reactors. such as SMRs, and Molten Salt Reactors.

Ultimately, the demand for uranium and nuclear energy is a natural outcome for the need for electricity. According to a September International Energy Agency (IEA) report, global electricity demand may grow 164.66% by 2050, relative to 2022.[1] Electricity demand is expanding with population growth and as developing nations modernize and urbanize.

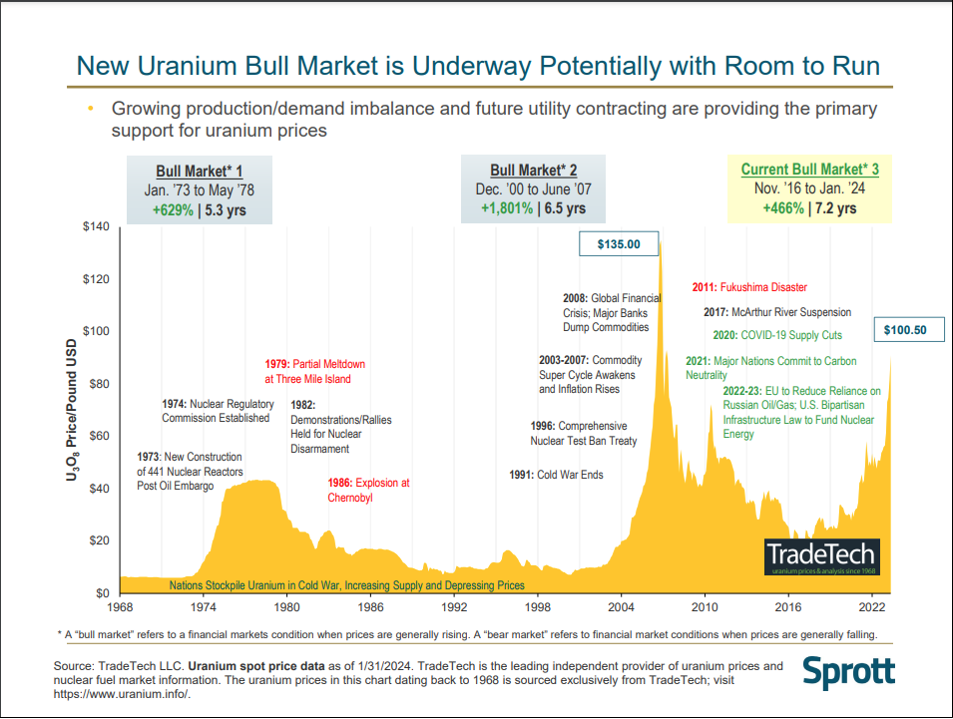

The TradeTech graphic below shows how the current bull market looks, and how far uranium can potentially run when compared to previous bull markets. If we take the last uranium price peak at $135/lb. and adjust it for inflation, we arrive at a price of around $300/lb. in today’s dollars. Therefore, we can see how much further the current uranium bull run may travel.

[1] Source: Climatewatchdata.org at https://www.climatewatchdata.org/net-zero-tracker as of 8/2/2023.

The investments and services offered by Grossmeister Capital AG may not be suitable for all investors, given the past volatility of the uranium market. This is not a recommendation or advice to invest in this fund. If you have any doubts as to the merits of an investment, you should seek advice from an independent financial advisor

Key Figures

| Return | -0.09% |

| Volatility p.a. | 23.17% |

| Maximum Drawdown | -18.89% |

| Cash Amount | 5.44% |

| Number of Positions | 32 |

| Sharpe Ratio | -0.24 |

| Sortino Ratio | -0.40 |

Historical graph

| Figures for the last month | For 6 months | Since launch |

|---|---|---|

| -5.88% | -19.78% | -19.17% |

Transactions Examples

| Instrument | PnL | Type of Transaction | Currency | Price | Date |

|---|---|---|---|---|---|

| Kazatom | -0.40% | Sell | USD | 39.60 | 21.06.24 |

| Sibanye | Buy | USD | 4.63 | 20.06.24 | |

| Energy Fuels | Buy | USD | 6.99 | 31.05.24 | |

| Denison Mines | Buy | USD | 1.95 | 25.04.24 | |

| NexGen | Buy | USD | 6.85 | 20.06.24 | |

| Fission Uranium | Buy | USD | 1.06 | 01.04.24 |

Documents

- Factsheet

- Extended version of the report English, 1,5 Mb, PDF

Contacts

Nuclear and renewable resource strategy follow the link to learn more