Grossmeister Capital AG is an independent wealth management company

We create and maintain investment strategies to protect capital from inflation.

At the beginning of 2022, there was a long-term trend of money depreciation. We were among the first to launch four strategies to protect investor portfolios against inflation. This allows us to show real results today, confirming the relevance of our strategies.

Below you can find out why inflation is with us for the long haul, explore each strategy separately and see the actual charts of our inflation protection solutions.

The inflation is to stay for a long time

Why inflation has become a problem

Key Takeaways

- High inflation leads to depreciation of savings, poverty, hunger, social anxiety, loss of confidence in financial institutions and the state as a whole.

- Central banks are constrained in their tools to fight inflation due to the high indebtedness of the economy.

- Each investor must act independently and minimize personal damage through inflation-protection strategies. The state is powerless here.

- Strategies act as insurance: investing a small percentage of assets is enough to protect the entire portfolio.

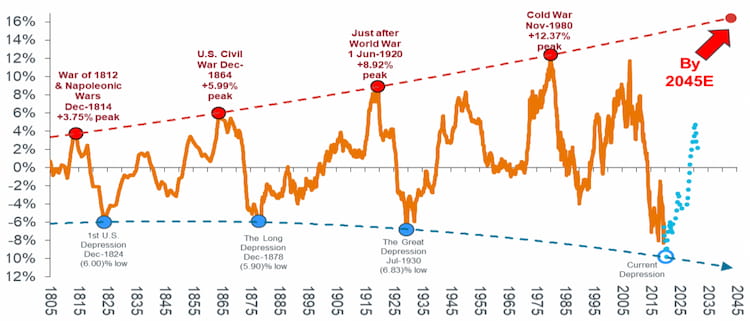

First of all, we would like to introduce you to the term "commodity supercycle. The commodity supercycle takes into account the value of commodities in the world over the past 200 years - see chart. We're used to raw materials being affordable and available, but it hasn't always been that way. If the trend of the last 200 years continues, commodity prices will only rise in the next decades.

On the other hand, central banks pursued a policy of low interest rates, increasing the money supply in their economies. The critical point was the allowances and various monetary incentives that were used during the pandemic.

We believe that these circumstances were the starting point for the onset of the era of high inflation. More about each reason below.

-

Increase of commodities’ prices

According to the super-cycle, the cost of raw materials will rise. The reasons may be different: natural phenomena, global warming, man-made disasters, wars, disruption of supply chains or geopolitical tensions. Each of these events is already affecting today and may have its own impact on inflation in the future.

-

High level of indebtedness

Central banks fight inflation by raising interest rates. But because the economy is heavily indebted, their ability to do so is severely limited, as this would lead to mass bankruptcies and threaten the entire financial system.

-

Geopolitical turbulence

In 2022, the world faces a worsening geopolitical crisis that inevitably calls into question the existence of the global economy. Increasing conflicts between countries lead to market fragmentation, which increases the imbalance of resources in global and local markets.

-

Inflation begets inflation

Rising prices are a source of high inflation going forward. We assume that prices will only rise and that cash will depreciate at an increasing rate. As of spring 2022, we are experiencing the highest inflation rates in 40 years, which is an unbiased confirmation of our prognosis.

Today we are seeing the highest inflation rates in the last 40 years, and they may remain at this level for many years to come.

Strategies we offer

In order to protect your assets we offer four unique strategies acting together as an inflation hedging portfolio. Choose a strategy if you like to discover more details: description, live performance and other useful information.

Allocation of 5% of your assets will protect up to 15% loss of value of entire portfolio

-

Real assets win

Commodity strategy

An asset protection investment strategy that earns when commodity prices rise. Suitable for investors who want to protect assets from inflation and major market corrections.

-

There are bills to be paid

Insolvency of loss-making companies

Investment strategy to protect the assets investing in value stocks versus growth stocks. Suitable for investors seeking protection against inflation and major corrections of the markets.

-

Proven by time

Golden Strategy

An investment strategy to protect assets, it earns when gold rises relative to the S&P500 stock index. Suitable for investors who want to protect assets from inflation and major market corrections.

-

This is just beginning

Sinking real estate market

Investment strategy to protect the assets, benefits from interest rate hikes and melt down of the real estate market. Suitable for investors seeking protection against inflation and major corrections of the markets.

Our mission is to introduce investors to solutions that will reduce the disruptive effects of inflation

Live performance of our strategies

Below you can explore live performance of our inflation hedging strategies. If you’d like to know why we think inflation is to stay with us for a long time, return to the part Why inflation has become a problem.

Last updated: December 29, 2023