Insolvency of loss-making companies

There are bills to be paidCore takeaways:

- Value stocks are less sensitive to high interest rates

- Strategy can act as hedge against market corrections for portfolios with high proportion of growth stocks

- Strategy is optimal in periods of high interest rates

Description

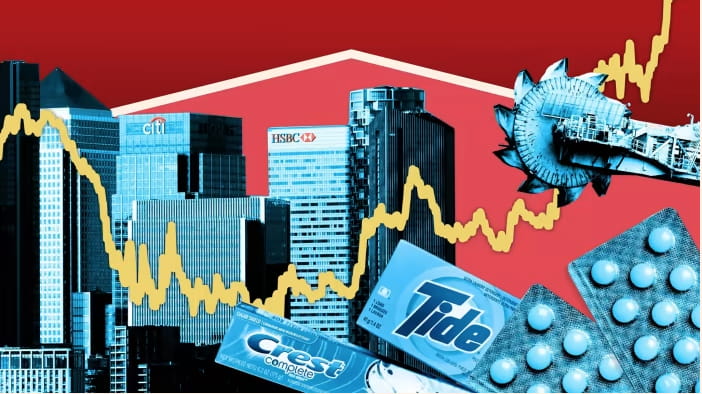

Inflation is suppressed by lowering economic activity through higher interest rates. Central banks around the world have already announced their first increases. Economists believe that interest rates need to be higher than inflation for them to have the right effect. We allow for different scenarios regarding the frequency and magnitude of rate hikes. However, interest rates will remain high in the near future. This already affects and will continue to affect the cost of capital (loans and investments). This environment will put significant pressure on corporate finances and corporate profitability.

Taking the above into account, we see a shift of interest towards value companies (niche companies, stable market shares, demand persists in different economic cycles) towards growth companies (technology sector, companies showing strong market share growth, often remaining loss-making businesses in the near term).

We expect investors to favour value companies. In the challenging environment of rising inflation, it is becoming more evident that profitable value companies have become more attractive and more able to pass on higher costs to consumers. This strategy is thus a hedge of portfolios with high exposure to value stocks, including technology companies. This is borne out by historical observation of the strategy during previous crises.

Exposure to value stocks is through investments in the most popular ETFs (e.g. VTV), to growth stocks through the Nasdaq index.

In order to assess the potential of the strategy, we used historical data on the change in value during the economic crisis in 2008. This strategy would have risen by 45%. It should be noted that inflation was not high in 2008 (3.8%) and there was no need to raise interest rates (the rate remained below 2%). For your own assessment of the scale, have a look at the chart below which shows the decades of dominant growth and relative decline of value companies up to mid-2020. We see the formation of a base for a trend change and the first signs of growth with great potential ahead.

- Issuer

- Leonteq

- Target return

- 50-100%

- Issue Date

- 04.01.22

- Redemption

- Daily

- Current Status

- Open for new investors

- Currency

- USD, EUR, CHF

- Lot New Issue

- 150 000

- Lot Increase

- 10 000

Important! Profitability in the past does not guarantee profitability in the future. Targeted yield helps define investment objectives and is not a limit or guarantee for an investor.

Contacts

To invest in Inflation Hedging Strategies or to ask a question contact us by phone, e-mail, Instagram, Telegram or WhatsApp.